Inside the realm of hard money funding, specific conditions are very important for stakeholders to grasp. "Loan-to-benefit (LTV) ratio" is often a critical metric employed by hard cash lenders to evaluate the quantity of loan relative to the value on the collateral home. Unlike typical finance where a borrower's credit rating rating and money are closely weighed, hard revenue lending prioritizes hard forex – the tangible asset – thus concentrating on the LTV ratio.

Material sponsored by eleven Financial LLC. 11 Money is usually a registered investment decision adviser situated in Lufkin, Texas. 11 Fiscal may well only transact company in those states through which it is actually registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s Web-site is limited to the dissemination of general information and facts pertaining to its advisory expert services, along with entry to supplemental financial commitment-associated information and facts, publications, and hyperlinks. For facts pertaining for the registration standing of eleven Monetary, make sure you Make contact with the state securities regulators for anyone states in which eleven Economic maintains a registration submitting. A copy of 11 Economic’s present published disclosure assertion discussing eleven Economic’s business enterprise functions, companies, and costs is accessible for the SEC’s expenditure adviser general public info website – or from 11 Economic on created ask for.

Groundfloor’s fees begin some 6% lessen than other lenders. Even its most interest price is just eighteen%. Certain, that’s in all probability higher than you’d hope to acquire, but it surely’s a lower optimum than you’ll uncover at quite a few lenders (even for common expression loans).

Dwelling equity lenders can offer household equity loans or strains of credit score that work as a second property finance loan loan and might include extra favorable phrases than the usual hard funds loan.

Another option to take into account is real estate crowdfunding. Patch of Land can be a housing crowdfunding Web site that connects borrowers and lenders. Fascination fees are fairly lower and the applying to funding is very quick.

Prior to delving right into a hard income loan, It really is paramount that buyers rigorously Consider desire charges as well as other involved expenditures to ensure the fiscal practicality with the undertaking. Assessments of loan-to-value ratios and equity offerings are integral to determining the click here collateral adequacy on an asset, be it household or commercial.

They could also offer extended repayment terms than a typical take care of-and-flip loan. But curiosity premiums for private loans can be larger compared to hard money loans, especially if you don’t have in the vicinity of-excellent credit history.

In contrast to numerous hard money lenders, Park Area Finance especially advertises its willingness to work with inexperienced investors as they get into real estate.

Our creating and editorial staff members certainly are a workforce of professionals holding Superior financial designations and also have created for the majority of major fiscal media publications. Our work has become instantly cited by organizations like Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and lots of Some others. Our mission is to empower readers with by far the most factual and dependable economic data doable to help them make informed decisions for his or her individual requirements.

On-line lending platforms streamlines the hard cash lending system, delivering borrowers with simpler usage of lenders and more quickly loan approvals.

Hard funds lenders offer financing for real estate traders who need to flip or rehabilitate a house, though some also offer you bridge loans, construction loans together with other property funding options.

Unlike private loans, dwelling equity loans also offer reduce, fastened fascination rates, earning them a preferred selection for homeowners. Even though accessing your home equity might be handy, remember that this may incorporate to the regular debt.

Considering the fact that hard cash loans have considerably less stringent prerequisites, they’re normally easier to obtain for borrowers with a lot less-than-stellar credit rating, a personal bankruptcy on their own file or other destructive goods on their own credit rating report. Hard money loans also are sometimes used by homeowners making an attempt to forestall foreclosure.

Within your posting you offered many great data for flippers, but we want the loan to buy out a sibling along with the lender will have to know the ins and outs for Prop 58 loan needs specially.

Luke Perry Then & Now!

Luke Perry Then & Now! Taran Noah Smith Then & Now!

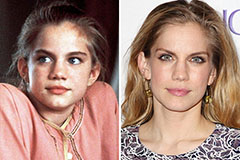

Taran Noah Smith Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!